Interview: We want to be a pan-European operator providing high-level storage services at every facility

Ladislav Barkoci, Sales and Marketing Director, talked about NAFTA’s corporate results and revealed his vision.

NAFTA’s key activity is storing natural gas in underground storage facilities. What is the storage capacity market’s current situation in Slovakia and globally?

We witnessed a boom in storage services in 2005-10 after major growth in gas consumption was predicted. Nonetheless, the 2008-09 financial crisis came as a rude awakening. Then energy-saving measures pushed consumption even further down, leveling off at around 400-500 billion cubic meters a year. Forecasts for further growth are not being met and the market is consolidating. For storage system operators, this means especially falling prices for short-term services and pressure to consolidate capacity. In the last three years, decisions have been taken at several storage facilities, especially in the United Kingdom, the Netherlands and Germany, to dispose of capacity. Total storage capacity in Europe has declined about 7 billion cubic meters to slightly above 100 billion cubic meters. In particular, old storage that either requires large investments or with high operating costs are being closed. This trend will be continuing for a while, but it’s certainly not going to be a major loss in the tens of billions.

The biggest change in storage was the 2010 liberalization, which launched significant trading. How has that changed NAFTA?

We have seen a marked increase in the number of customers. This means relationships with our customers have become more energy-related. The entire market is much more creative today and demanding from us more than just storage. So that’s why we’re bringing our clients an extensive portfolio of innovative products.

What top innovation has NAFTA brought to this changing market?

This past season saw the introduction of framework agreements for storing natural gas. We’re signing contracts with clients that tell us exactly in advance what trades to make and define the rules for them. Then we can very quickly close a specific trade. The process used to last a few days, but now we close trades in a single day. The framework agreement covers all standard storage services, but is also tailored to additional, innovative services such as options, inverse product and intra-seasonal storage capacity. It helps traders take advantage of short-term business opportunities in the gas market, which in turn lets us exploit our storage capacity more.

How would you evaluate last year’s season on the market?

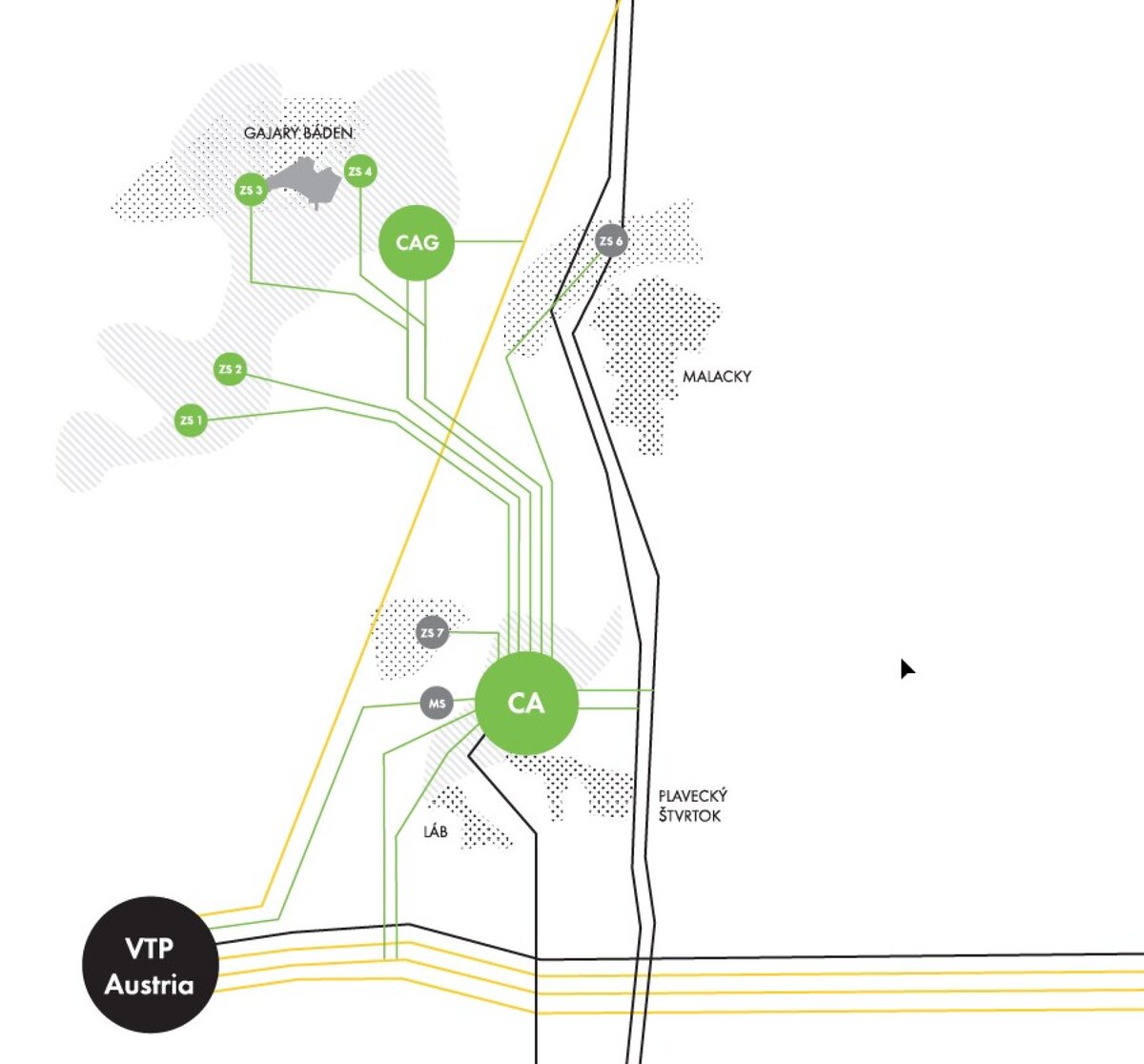

Looking at the storage season, it was very similar to the previous year. NAFTA reached an important milestone in its development projects, successfully acquiring three underground gas storage facilities in Bavaria from DEA Deutsch Erdoel AG and Storengy Deutschland GmbH to turn us into an international player in the storage services market. It was a major step, as NAFTA had long operated in Slovakia, Austria and the Czech Republic. Now, we’ve shifted further to the west.

What is NAFTA’s customer mix like?

A great benefit from our foreign expansion is that we can motivate NAFTA’s customers in Slovakia to store their gas in Germany as well. And it works both ways. Thanks to our international presence, customers abroad that had never before considered Central Europe are now thinking about storing natural gas in Slovakia. There is a clear synergy.

You earlier mentioned NAFTA’s strategic and most significant investment yet, namely the acquisition of storage in Germany during 2018. Even if the facilities are only operating half of the year, what do the results show?

Our ambition is to be a pan-European operator providing high-level storage services at every facility. It’s like going to a Starbucks anywhere in the world and knowing what to expect. This is the vision about storage in Europe we want to see come true. It’s a major benefit and for us has great growth potential.

Such a solution essentially presents itself. Why hasn't anybody else come to the market with it yet?

Historically, large companies operated in the countries where they were established. They locked themselves to the local environment. This happened even with foreign investments. When NAFTA was owned by E.ON and Gaz de France, there was no grouping of capacity under a single brand. Of course, a barrier was the diverging legislation that aligned Europe’s energy market in 2008-12. Today, we have the advantage of standard rules having been put in place. NAFTA’s goal is now so perfectly natural.

Another essential factor is the change in contracts. Ten years ago the market operated primarily through long-term agreements, but today there are a large number of smaller and more short-term contracts. Storage used to be sold off for 10 years in advance, but now there are options opening up to look for synergies. If someone is trading in natural gas every day, NAFTA has the potential to bring it to other markets, too.

What is different about doing business in Germany? What surprised you there?

While the framework for doing business is essentially identical, there are some application differences we are endeavoring to understand. This is what’s pushing us forward. Acquiring German storage also allowed us to compare and share technical know-how between Slovakia and the rest of the world. It’s clear from our experience that NAFTA has clever, tech-savvy engineers, geologists and support staff. Through them, we’re operating the German storage facilities better than the original staff did, since it wasn’t their core business and, logically, they didn’t have as much experience with them as we do. We want our activities to be cost effective, even in other countries. At the end of the day, all this should be reflected in better business products.

Today, NAFTA has a storage capacity of 60 TWh and is the sixth largest storage system operator in Europe. Are you looking at additional acquisitions to further strengthen your market position?

Our strategy is simply to grow further. NAFTA is currently studying acquisition opportunities in Germany, the Netherlands, the UK, Turkey and Ukraine. What matters is that we are not buying anything just because it happens to be for sale. We are looking for similar synergies like in Bavaria, cost advantages or at another business model. It’s certainly true that markets farther west are much more liquid than CEG in Austria. For us it’s an advantage to have a presence in a more developed market, and then to apply our new experiences in Slovakia.

In Ukraine, NAFTA has been active abroad longer in hydrocarbon exploration and production. How do these activities fit with the acquisition of the underground storage facilities?

Right now we see synergy in two ways. First is the ability to share know-how, local market knowledge and contacts between the two different types of projects. This is without doubt a benefit. Secondly, there’s the naturally unfolding risk in the projects. For example, NAFTA managed better in Ukraine to win new licenses for the production of natural gas, while in Germany we were excelling at storage.

As a pan-European operator, NAFTA operates in five Central European countries, namely Slovakia, Austria, the Czech Republic, Ukraine and Germany, and offers homogeneous services. What is the biggest advantage of such a business position?

Sharing customers is a benefit, but so is homogenizing products. In other words, we can expand proven products from Slovakia to other markets. On the other hand, if the market works better abroad in some parameters, we can apply the experience there back in Slovakia. This multiplies the effects. We are also shifting in regulation. When you know how the market works in Germany, as a leader you can now talk differently to regulators in Austria and Slovakia. This puts us in a better position in subsequent acquisitions.

Gas-to-power is a traditional model for using natural gas, where electricity is produced from gas. Today, there is discussion about going the opposite way; about power-to-gas built upon the idea of storing energy from renewable resources and injecting hydrogen into the natural gas. What is NAFTA’s vision of this new energy segment?

NAFTA sees itself in the future as a universal energy storage operator and exactly in the storage of energy in the form of natural gas. We see great potential in the need to store more energy as the percentage of renewables in the electrical grid rises. Looking into the more distant future and a system built on 100% renewable resources, a large volume of electricity is going to have to be stored. It is only natural for energy storage operators to be the key players here. The big advantage is that major investments will no longer be needed because the basic infrastructure already exists today.

NAFTA was part of Underground Sun Storage in Austria, testing energy storage by mixing natural gas and hydrogen. How close did you get to the practical use of this technology on the market?

It shows from a technical perspective that such a solution is feasible. No commercial business case exists yet because regulation of the entire sector and basic rules are missing; for example, the percentage hydrogen allowed to be distributed now in the grid. Moreover, legislation is not ready yet for such a change. If electricity were to be taken from the network now, with the hydrogen produced by electrolysis to be then resupplied to the network, we would have to pay electricity distribution levies as energy end-users. That means now the burden of additional 50-60 euros per megawatt hour distribution charges on top of the price of power. However, storing electricity makes absolute economic sense because of fluctuating energy prices. Take the electricity from the facilities at a low price and deliver it to the network when prices are high. In the future, I expect conditions to be unified and simplified.

What are NAFTA’s predictions for the European natural gas market in the future?

In 15-30 years, gas will be underlying the transition to a low-carbon society because it is a substantially cleaner fuel than coal. Just reducing the percentage of coal in the energy mix and raising the percentage of gas will achieve energy and environmental savings, something seen in the US, for example. As the share of renewable resources rises, the percentage of electricity sources that can be regulated will have to increase, too. Today we are seeing COGAS power plants that one day will smooth fluctuations in the electric grid. And in another 10-15 years, we believe that natural gas will start to be replaced with green natural gas or hydrogen. This is the notion of storing electricity.

About Us

company profile of NAFTA

NAFTA is an international company with extensive experience in natural gas storage and underground facility development in Slovakia. It is also Slovakia’s leader in exploration and operation of hydrocarbons. In Europe, the company actively operates gas storage facilities, carries out exploration activities, and participates in projects focused on energy storage from renewable sources.

More

NAFTA provides development, engineering and advisory services for facilities with overall storage capacity of approximately 64 TWh.

Company history